WHAT IS USER RESEARCH AND WHY IS IT USEFUL?

Almost every other blog post on UX says “Listen to your users,” “Know your users,” or “Understand your users.” And you know what? They are right. Just google “user research,” and you will find endless “how to conduct user research” and “simple techniques and methods.” The first thing to remember is that although there are hundreds of such techniques, you don’t have to use all of them. You should pick up those methods that will be the best fit for your business and project.

Especially when it comes to developing a fintech product – mobile apps and websites that aim to improve the way people manage money. We are sure that the key to taking a leading position in the future financial market will be wearing users’ shoes.

What’s covered in this blog post?

- What is user research and why companies should bother it?

- The importance of user experience research for fintech digital products.

- What do we pay attention to when conducting research at CXDojo.

WHAT IS A USER RESEARCH AND WHY COMPANIES SHOULD BOTHER IT?

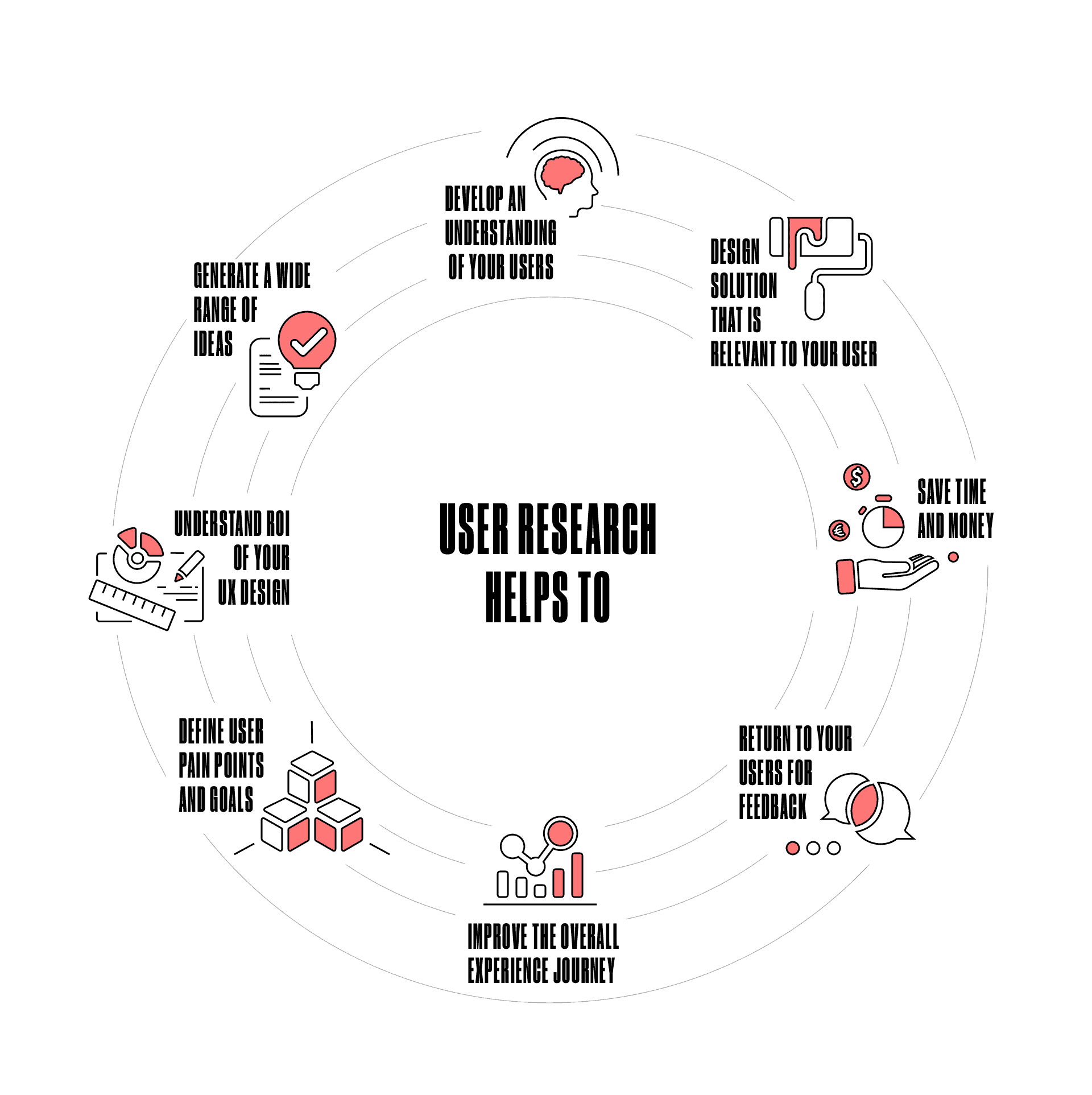

Users have different backgrounds and ways of life. The question is how to create products that consider those unique needs and expectations? User research aims to gain clarity on a number of objectives to strategize with more accuracy.

Development teams or companies often neglect user experience research, accounting for lack of time, budget, or already possessed enough information about users to build the product. So what happens if you don’t do user research?

- The chances of product failure increase, because most likely, the user experience and some product functions won’t be optimized for the end-users.

- The product has features that don’t solve the user’s problems at all.

- The product isn’t user-friendly as it is designed based on personal assumptions and preferences.

WHY USER RESEARCH IS AN INTEGRAL PART OF THE DEVELOPMENT PROCESS?

Conducting user research can help create useful and meaningful products. Here are a few more reasons why it should be an integral part of the digital product development process:

- Research makes the design, usability, and product performance better. It helps to understand the user’s needs, behaviors, and motivations better and transform them into meaningful products.

- User research is a way to fill in any gaps in our knowledge about users on what they do and when they do it, why they do it, and how can we help them to do things easier and more convenient.

- User research is a basis for the initial design and architecture of the digital product.

Definitely, user research does require additional time to plan and implement. However, neglecting it can be risky and turn out to have a completely unnecessary product to users. On top of all this, if you don’t conduct user research and your product fails, you might even have no idea why it failed.

USER RESEARCH FOR FINTECH DIGITAL PRODUCTS

When designing a product, you start with the user and not technology. Keep this in mind when designing financial products or services aiming to help people organize their finances. Design isn’t only about appealing product look. It’s also about how the user feels when interacting with the product or service, and here is where user research helps to figure it out. To deliver true value and improve people’s lives, focus on empathy and understanding user’s headaches and problems that need to be solved. Unfortunately, not all financial companies and banks realize how some financial situations can positively and negatively affect people’s lives.

THE VALUE OF USER RESEARCH: EXAMPLES

For example, you need to send a money transfer to your grandmother who lives abroad. You ask for her Swift code and IBAN (international bank account number). As grandma rarely contacts her bank, she might find it difficult to find this data immediately. This is the result of when banks create financial services based on their understanding. They forget that their users don’t possess that much financial knowledge, and to receive this kind of information, they need to contact support. Calling support each time you need to make a financial operation sounds tedious and time-consuming.

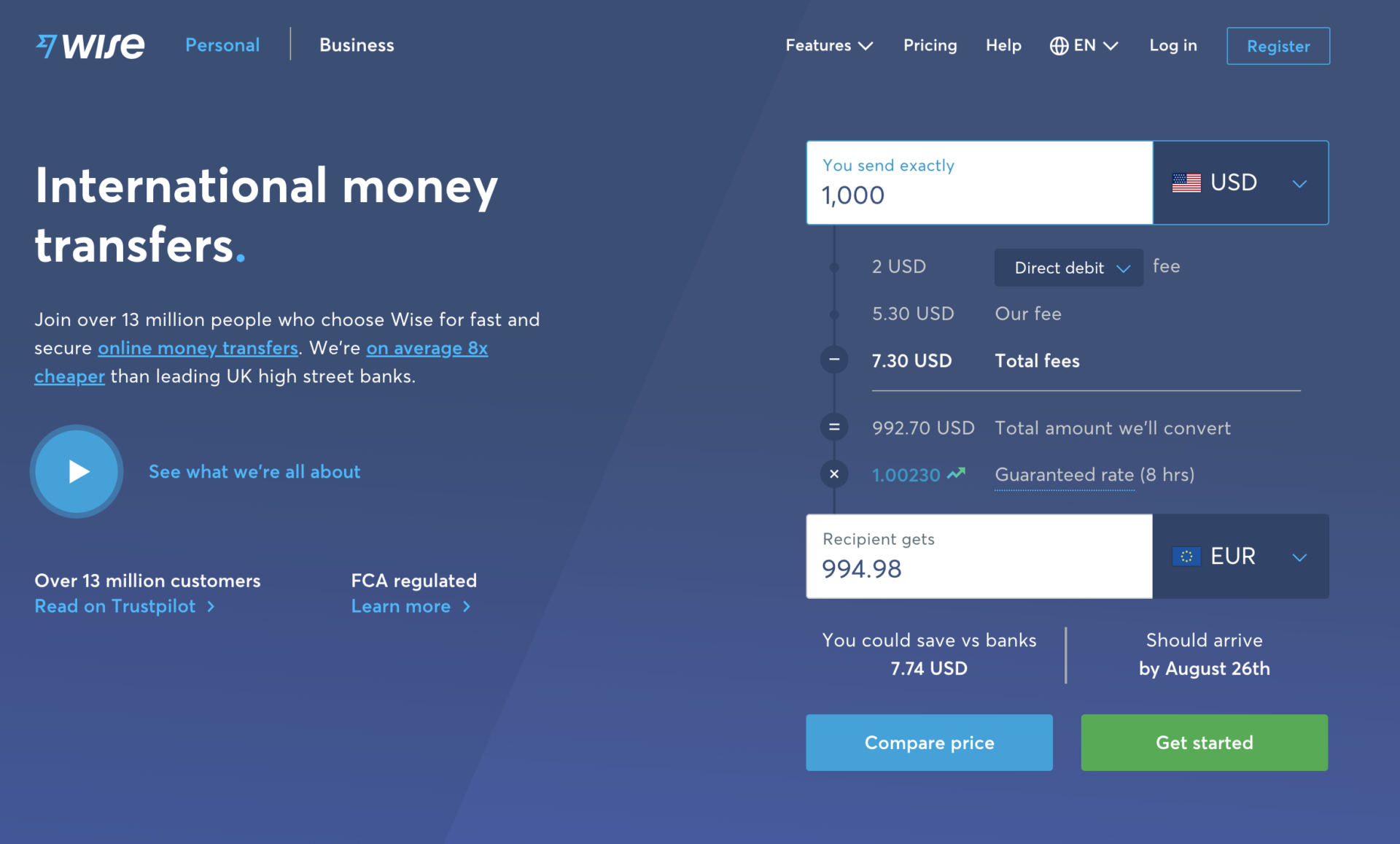

On the other hand, there is a fintech application Wise. With Wise, you just ask grandma to take a picture of her card number and send it to you. Voila. You make a money transfer without stress.

ASK AND LISTEN MORE

When working on digital product design and development, we apply various types of UX research. Still, we are always consistent in that all of them stem from the key methodologies: observation, understanding, and analysis.

OBSERVATION

We notice whether interviewees are stressed or uncertain during user interviews and pick up on references that may be further examined. Our researchers train themselves to observe people, take notes so to find correlations across diverse focus groups.

UNDERSTANDING

For UX researchers, understanding relates to mental models. A mental model is an image that people have when they think about certain services or situations. When thinking about using digital banking products, we often suppose that they are difficult and boring.

According to a survey conducted by D3Banking, 68% of digital banking users in America are frustrated with their financial experience. This is also partially the result of users’ not thinking about the mental models and overall perception of digital banking products. What model do your customers’ minds create when they think about using a new banking app? Do you know what they expect to see? As finances usually confuse many people, it’s important to understand your users’ mental models by researching them. The fewer discrepancies between the mental models and product design, the less time it will take for users to understand it.

ANALYSIS

To obtain out and away insights from the research, you need to analyze it. The analysis is a process during which the researchers identify patterns, present their own observations, propose possible solutions and recommendations. Analysis can be expressed in personas, scenarios, user behaviors, graphs, and statistics. And don’t forget to share research results with the entire team.

PROVEN UX RESEARCH TECHNIQUES

We distinguish the following research techniques that have proven to be most effective. They give us a clear understanding of the positive and negative aspects of products and services being developed, the users’ reactions, and ways to bring real value at different stages of digital product development.

USER PERSONA

Start with creating user persona profiles. They help us to visualize target users and build a product around them. Each persona represents a specific end-user type and includes a precise description of their age, daily routines, thoughts, goals, and fears.

CARD SORTING

Card sorting is a simple way to organize information, such as your website or app navigation. During a card sorting session, participants divide topics into categories that make sense to them. You are free to use actual cards, pieces of paper, or online card-sorting software tools.

USER INTERVIEWS

User interviews help to understand people’s motivations, headaches, and behaviors while using different products. We follow a structured methodology during the interview: the interviewer prepares a series of questions and topics in advance and analyzes the answers after the interview. For example and inspiration, here’s a list of questions for UX research asked at Google, Amazon, Microsoft, and Facebook.

USABILITY TESTING

Usability testing helps us see if the website or an app is usable and observe the users’ reactions while interacting with the product. This technique brings many benefits: collecting valuable information, improving UX, identifying any problems or bugs, increasing product efficiency, and ensuring user satisfaction with a product.

SUMMING UP

To build a financial product that customers will use requires a new way of thinking about finances through their eyes. Therefore, when focusing on users’ real pains, financial companies and banks can’t only improve the usability of products. They should also build loyalty with their target audience and shift to becoming more human-centered.

At CXDojo, we put great emphasis on user research and analysis of users’ behaviors. It helps us to stay in touch with users’ real-world needs throughout the design and development process. If you’re interested in knowing more, receiving a consultation, or conducting UX research as part of your project, all you have to do is contact us.